Abstract

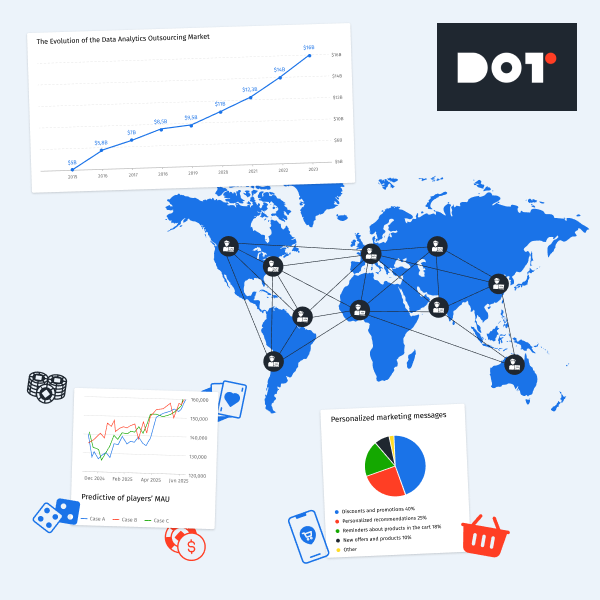

A practical, production-ready approach to reduce churn, grow LTV and boost revenue using

centralized data, real-time dashboards and ML-powered interventions. We implemented it for mid-size iGaming product (free-to-play with gacha mechanics, global audience).

Goal was to reduce churn of top-spenders (whales) and increase LTV while optimizing marketing spend.

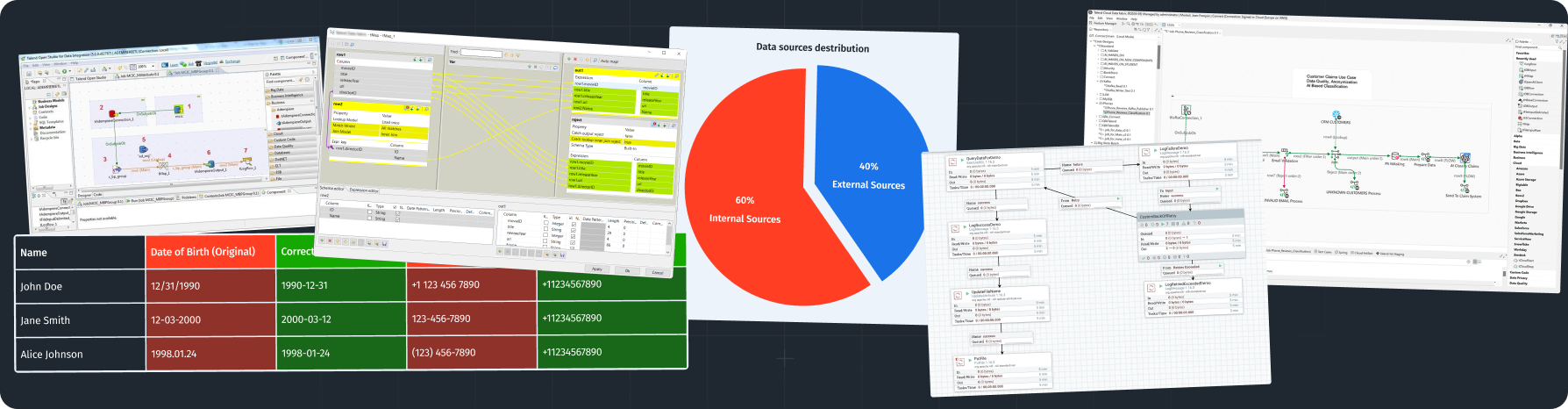

Dataset consisted of 6 months of logins, sessions, level-ups, in-game purchases, transactions events for 2 million MAU, and hitorical purchases for 120k paying users. Also dataset was joined with ad data and campaign data.

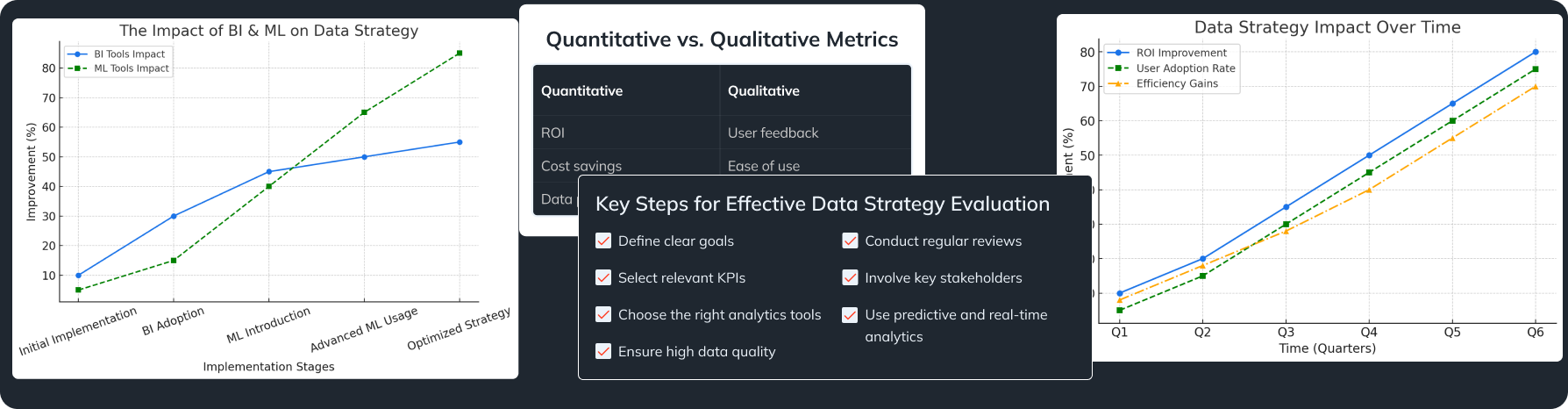

Key results

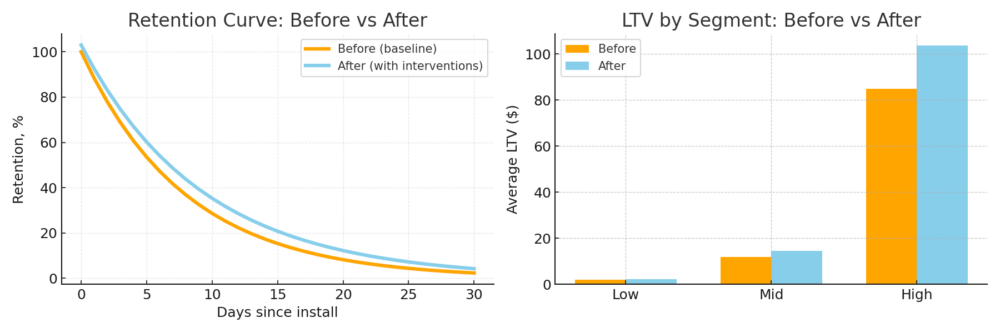

AI models impact on retention rate and players LTV.

- Churn rate reduced by 18% among targeted cohort.

- LTV increased by 22%. for top players.

- ROMI improved due to churn rate and LTV improvement.

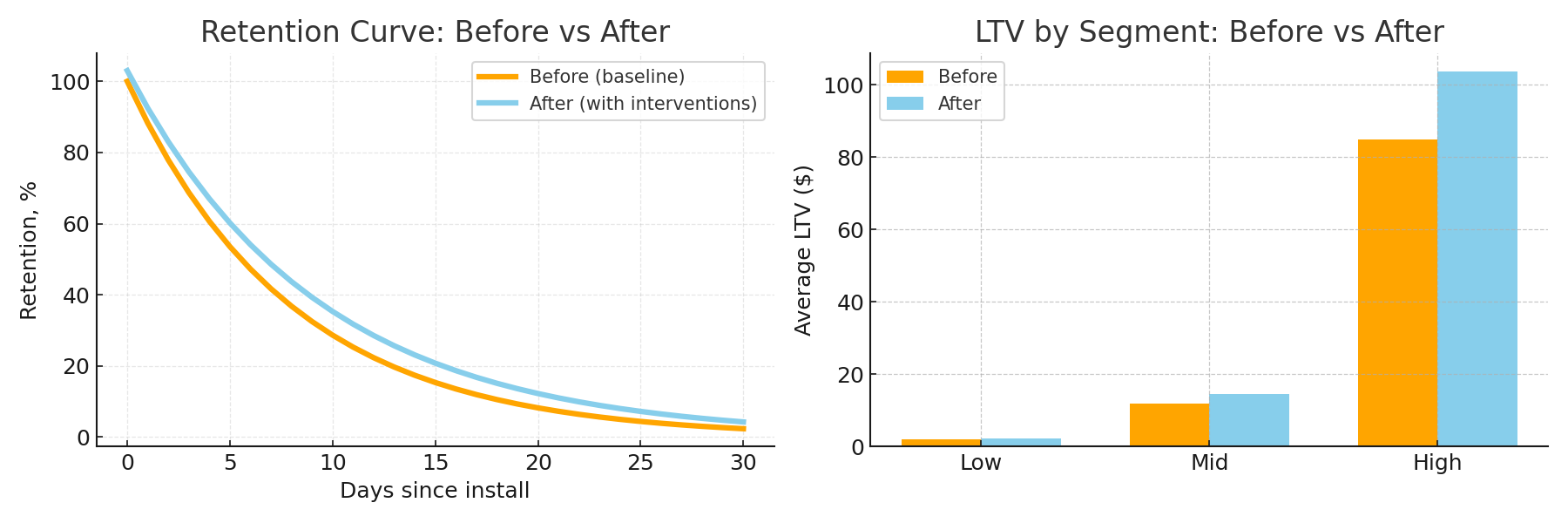

Industry challenges

- High player churn: free-to-play dynamics lead to fast drop-off of casual players.

- Concentration of revenue: small share of players (whales) generate majority of income.

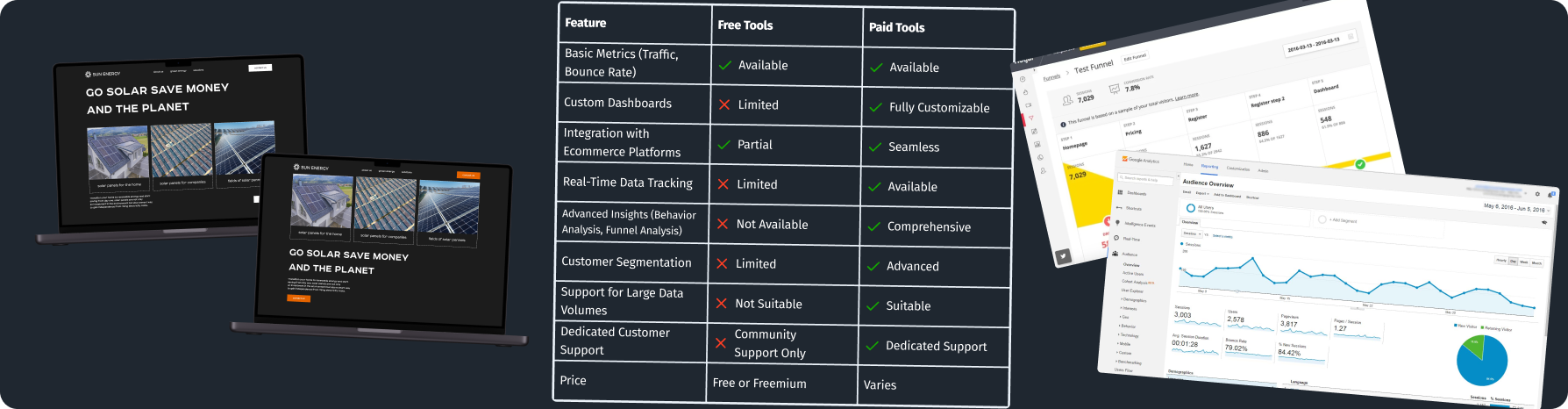

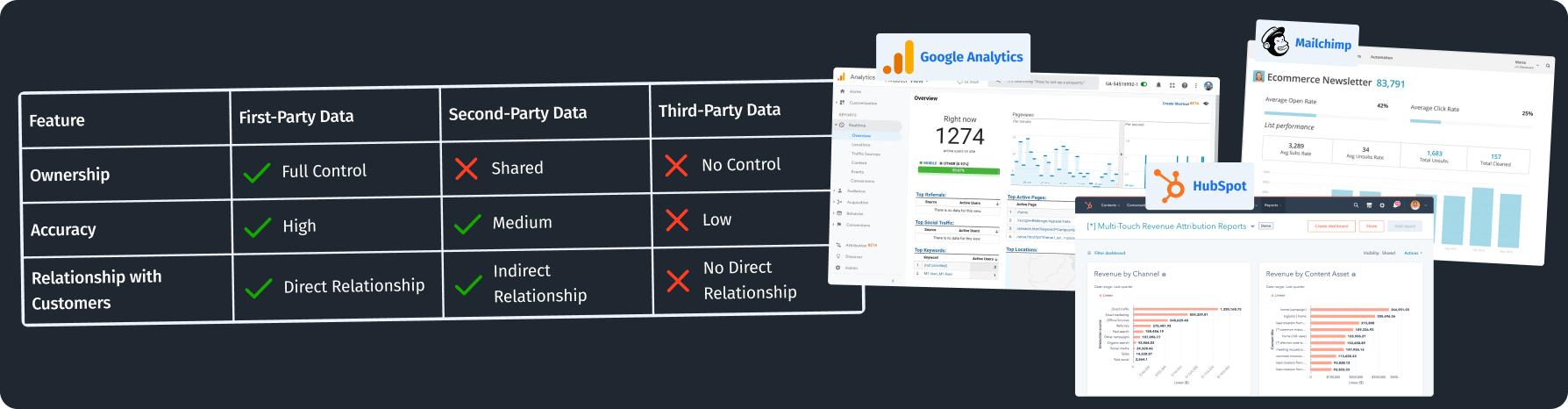

- Fragmented data across game servers, CRM, payment and ads platforms.

- High acquisition cost — poor targeting wastes marketing budget.

- Risk of fraud that damage revenue and thrust.

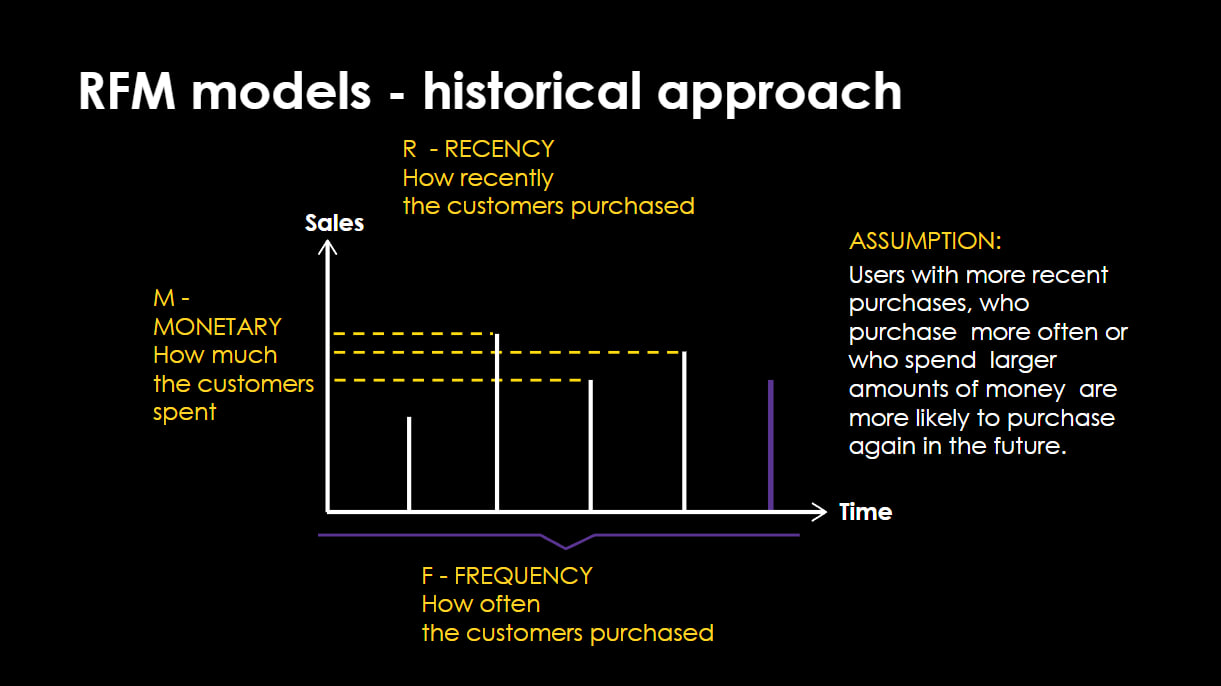

Modelling churn rate: RFM model

We started with the classic approach: RFM models for segmentation. But that wasn’t enough — more accurate predictions and personalization were required.

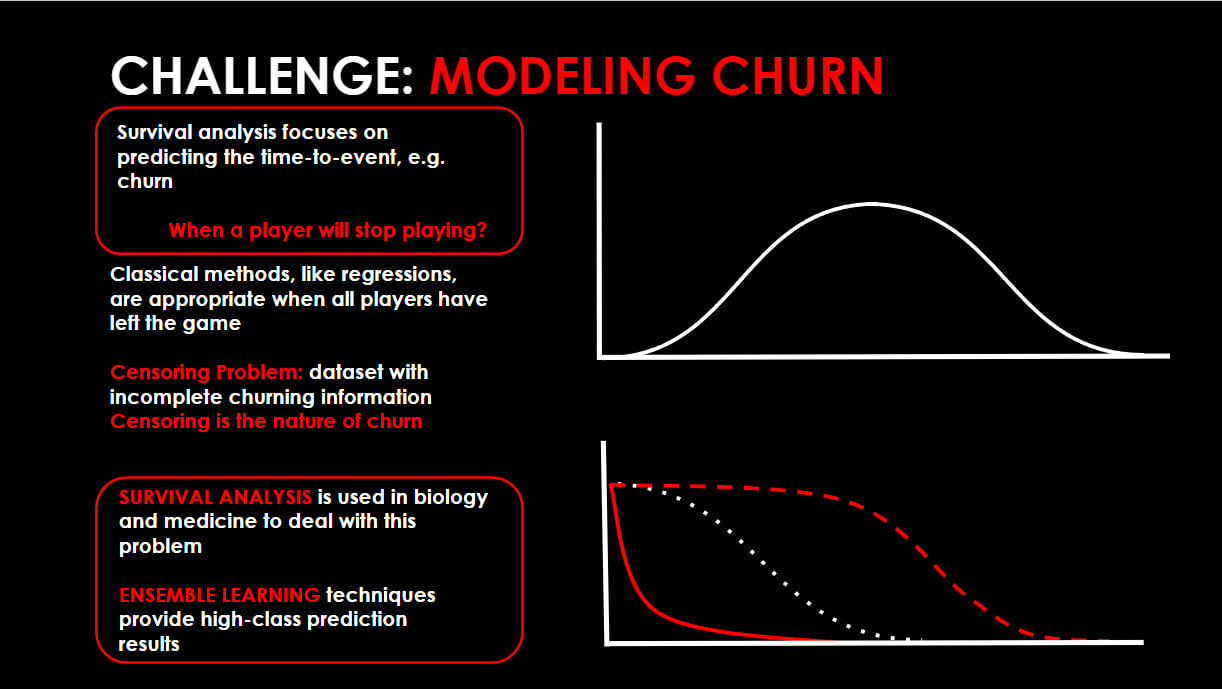

Modelling churn: Machine learning solution

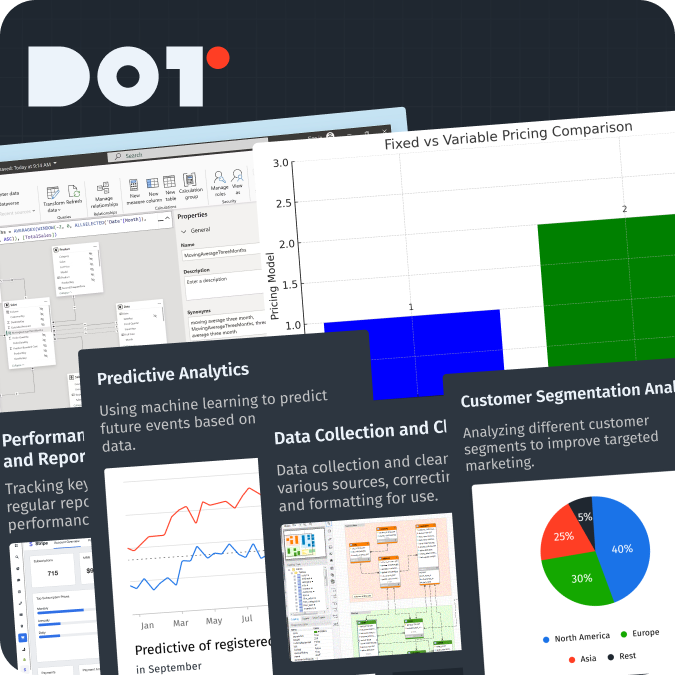

Our approach was to apply survival analysis combined with ensemble models (Conditional Inference Survival Ensembles, RSF) to predict both time-to-churn and churn probability for targeted interventions.

Key modeling techniques included autoencoders for dimensionality reduction, dynamic regression for covariates, and parallel training to handle millions of monthly active users (MAU).

The feature set used for learning consisted of playtime, sessions, recency, frequency, in-app purchases, action-distance, level-ups, and social signals.

Actioning: we mapped the predicted churn risk to personalized retention campaigns, including timed bonuses, push notifications, and VIP offers.

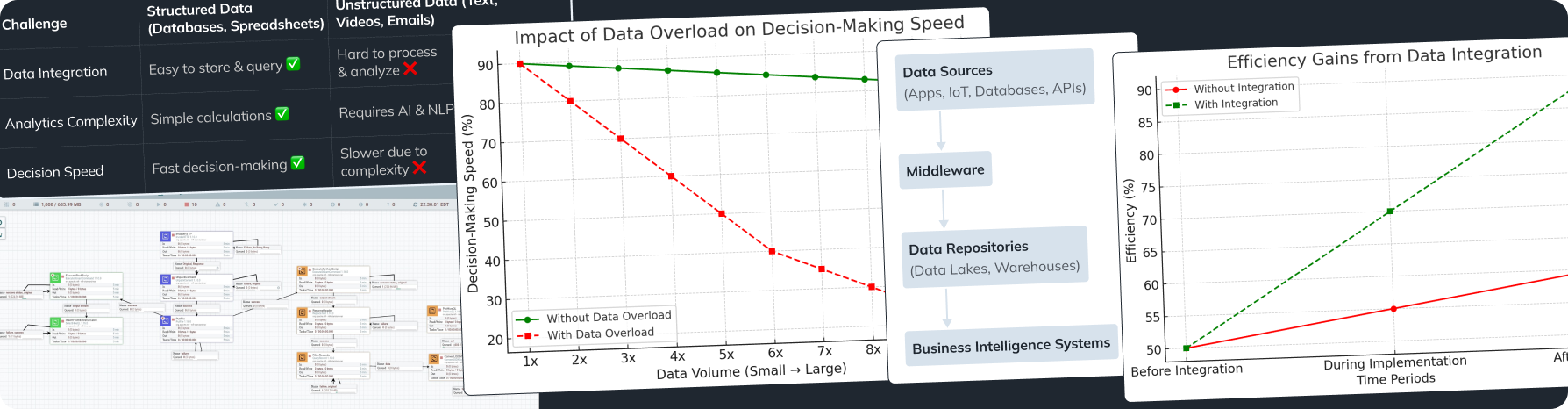

Modelling lifetime value: Machine learning solution

Our approach was to apply hybrid models — parametric (Pareto/NBD, MGB/CNBD-K) and deep learning CNN. CNNs learn directly from raw time-series without extensive manual preprocessing and improve accuracy for top spenders.

Output included per-player LTV, uncertainty intervals, and segment-level forecasts for budgeting. This allowed to estimate expected future revenue per player to prioritize acquisition and

retention.

Actioning: bid and creative optimization, VIP targeting, promo ROI attribution.

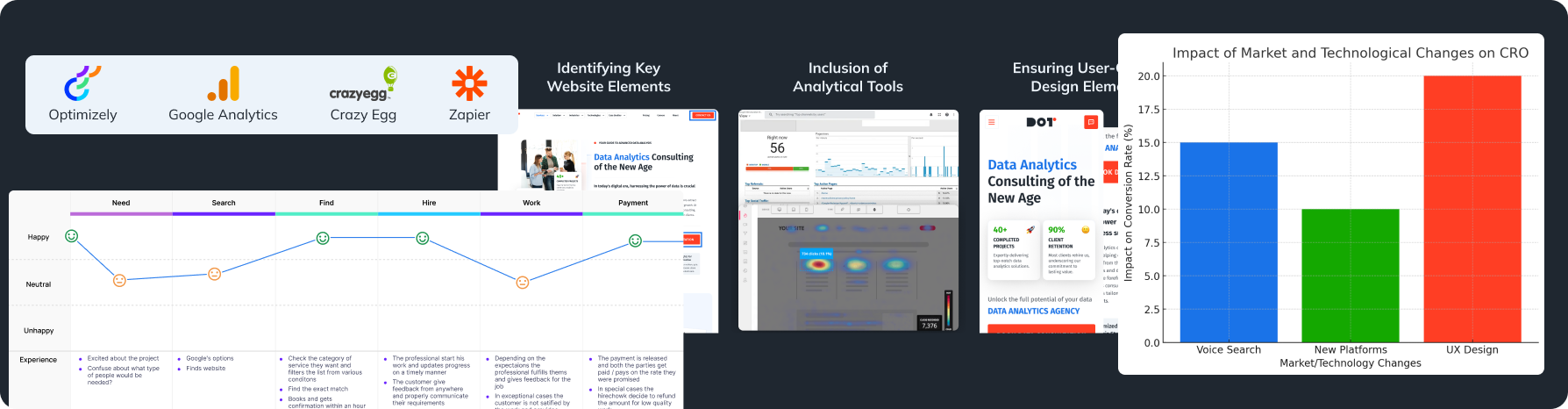

Modelling personal recommendation: Machine learning solution

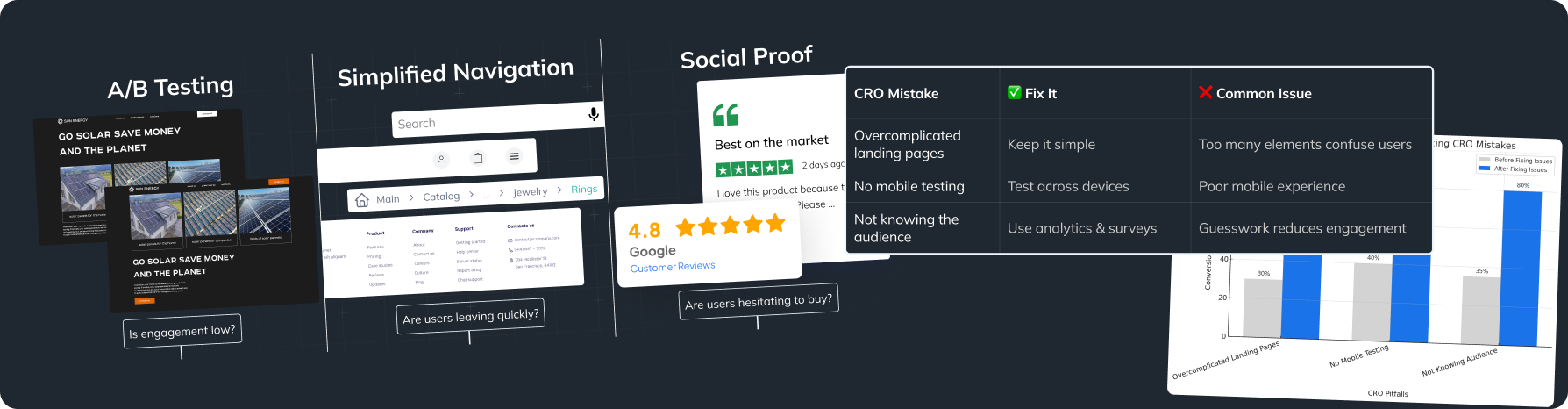

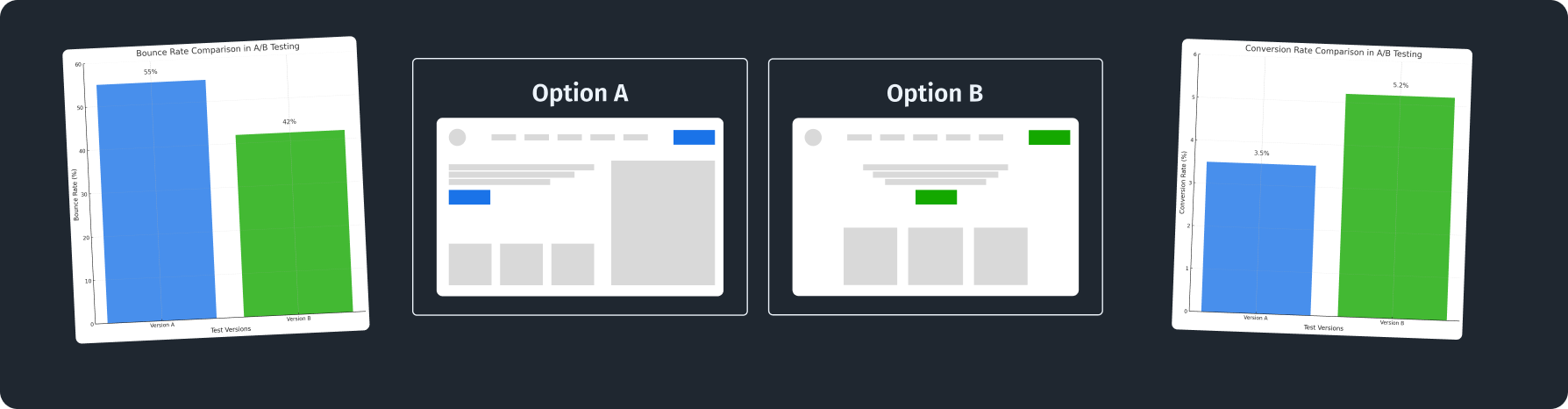

Our approach was to use Extremely Randomized Trees (ERT) for scale, LSTM for temporal personalization with hybrid feature selection and feature ranking. Personalized recommendations increase conversion of in-game item purchases. Validation was done by A/B-testing and measurement of revenue and retention uplift. For real-time operations was used Vertex AI and Redis cashe.

Actioning: item recommendations, gacha tuning, personalized offers, push messaging

content.

Modelling in-game events: Machine learning solution

Our approach was to use ARIMA, GBM, GAMM and ensemble approaches for time-series forecasts of sales and playtime. We simulate event combinations such as limited-duration tournaments, gacha params to maximize revenue and engagement. It matters because by picking event types, timing of events, and rewards we increase retention and ARPPU.

Our workflow consist of 3 steps: simulate future scenarios → A/B testing for best candidates → deploy winners.

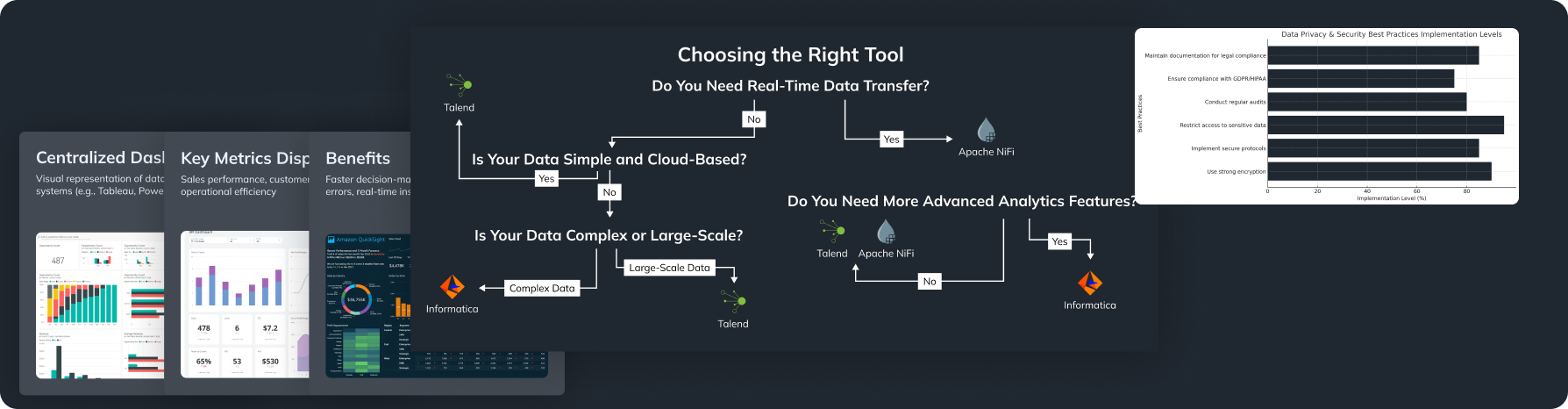

Fraud and anomaly detection: Machine learning solution

Our approach was to monitor payments, account creation patterns, and gameplay anomalies with ML anomaly detectors. We use unsupervised models, autoencoders, rule-based systems and human-in-loop review for high-risk cases.

Immediate actions: suspend suspicious accounts, flag payments for manual check, reduce chargebacks.

Outcome: lower fraudulent revenue loss and healthier KPIs, protected revenue and thrust.

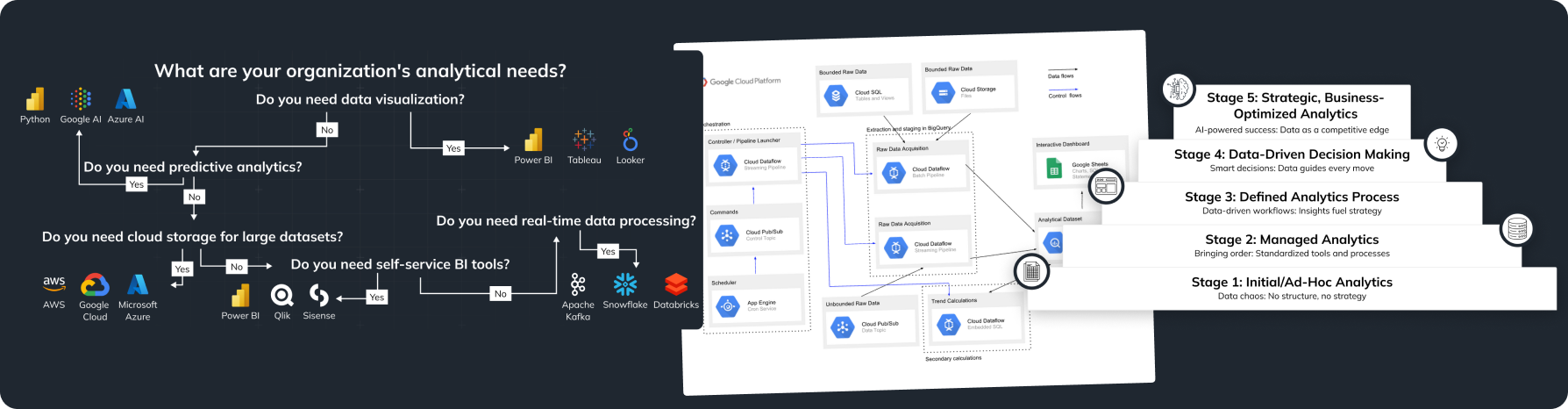

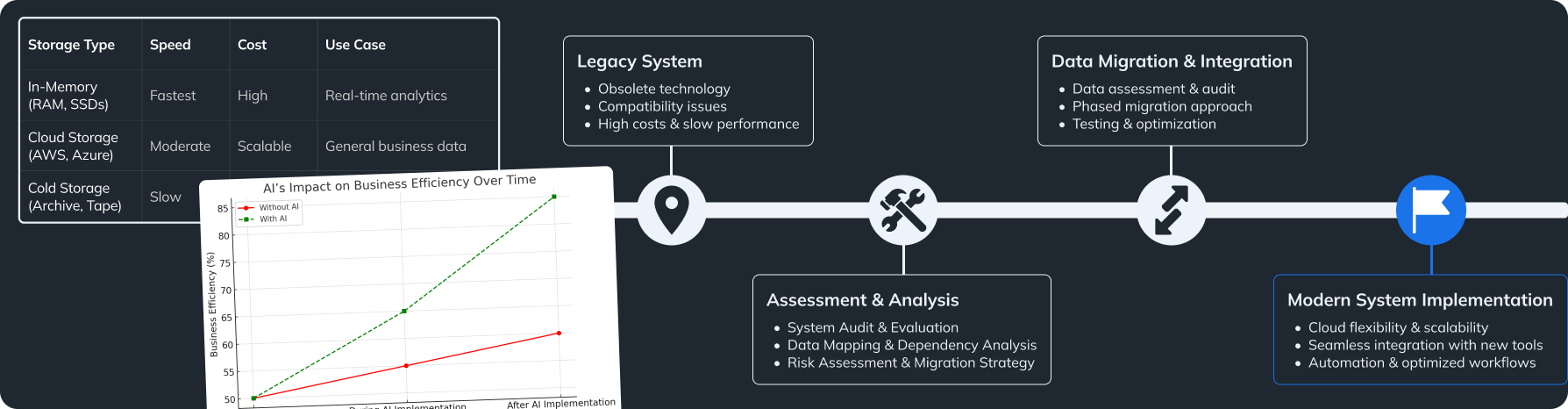

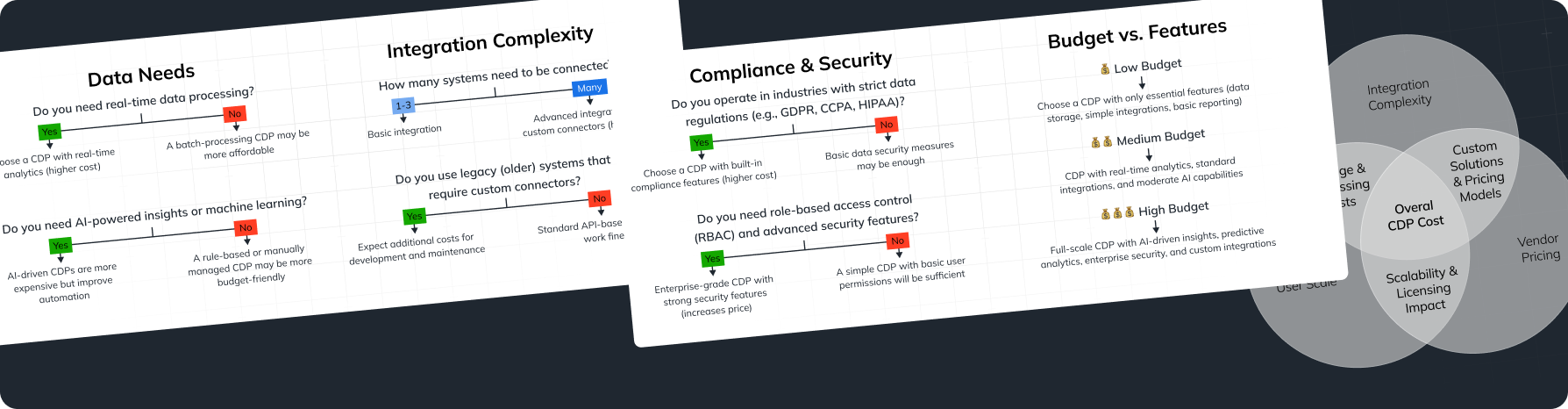

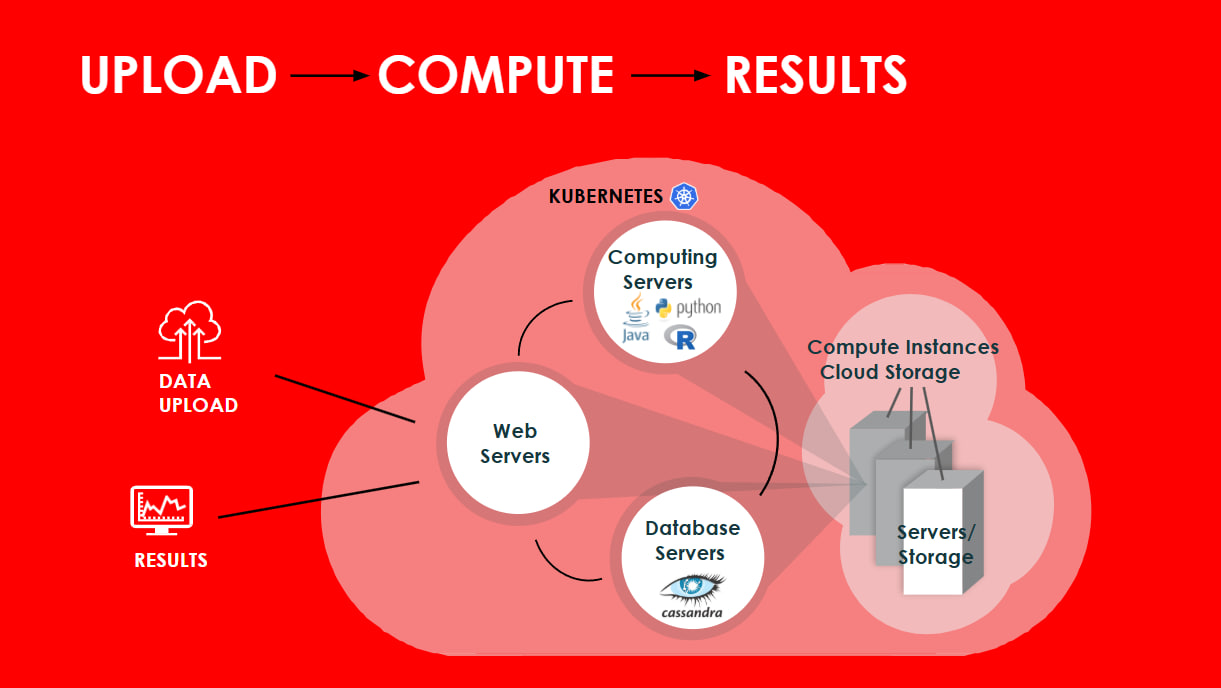

How we did it: Infrastruсture, data architecture and machile learning stack

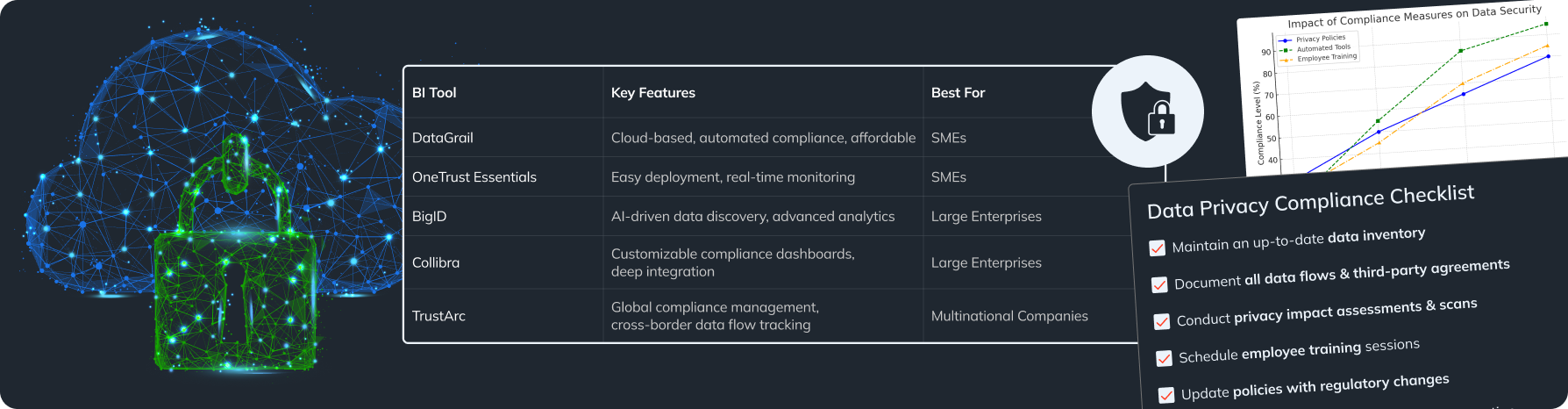

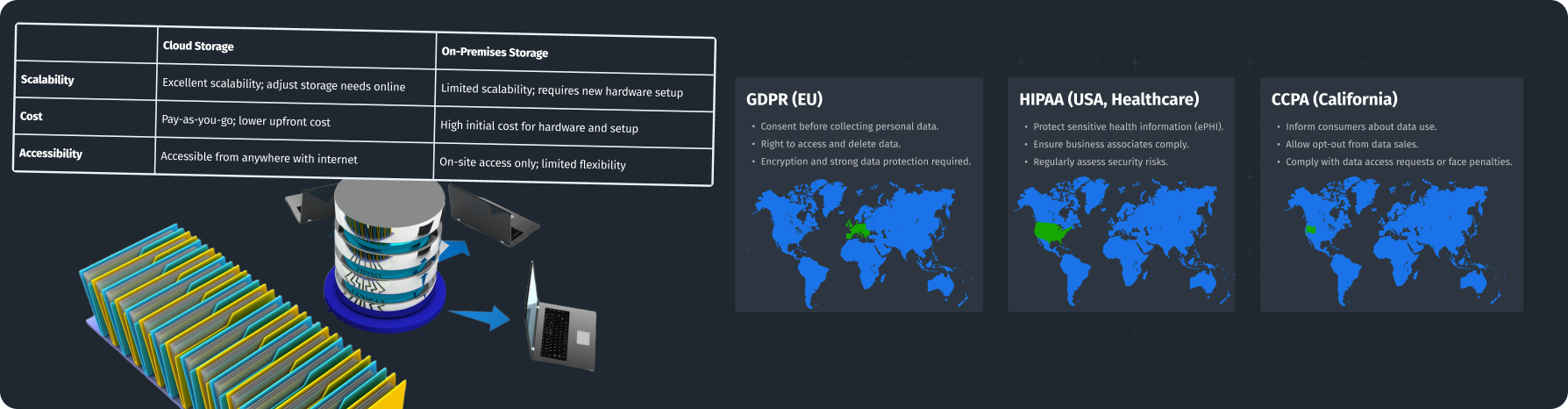

Cloud: Google Cloud Platform.

Compute: Vertex AI for model serving, Kubernetes and Docker for scalable model training.

Storage database: Cassandra and BigQuery for scale with replica and backup scripts for durability.

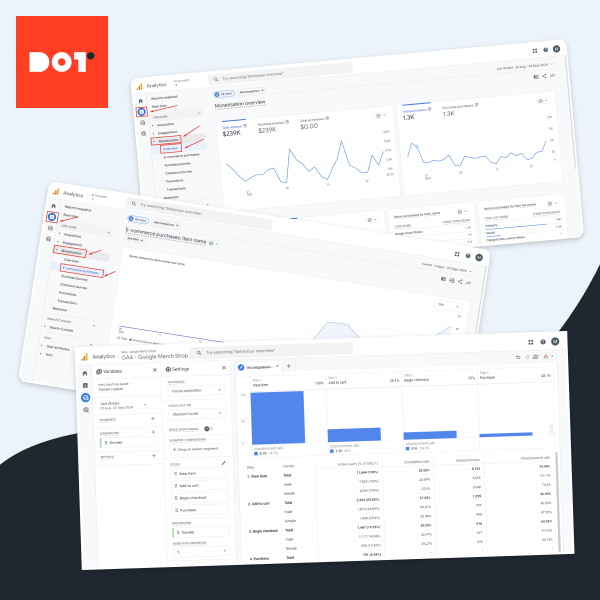

Monitoring: Looker studio dashboards for data quality checks, Python alerts for model drift detection.

Security: encryption at rest / in transit, IAM, VPC, SOC / ISO compliance where required.

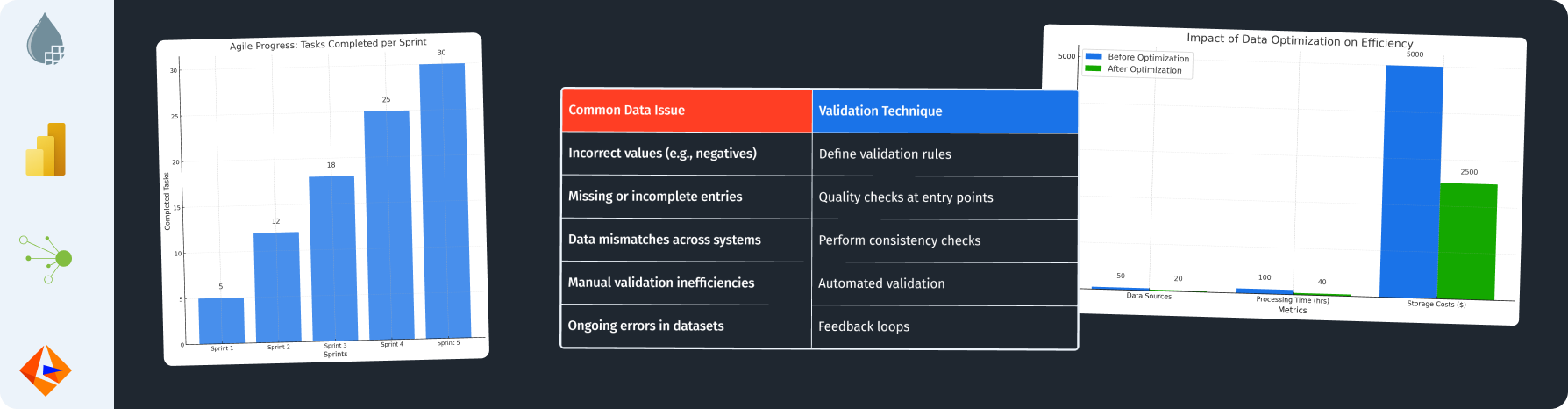

How we did it: Data improvement

- Centralize events and transactions in BigQuery data lake.

- Design ETL and consistent, auditable event taxonomy for product and monetization.

- Feature engineering: time-series, static features, sessionization, autoencoders for embeddings.

- Train models: churn, ltv, recommendations and fraud models.

- Deploy and serve predictions via Vertex AI;

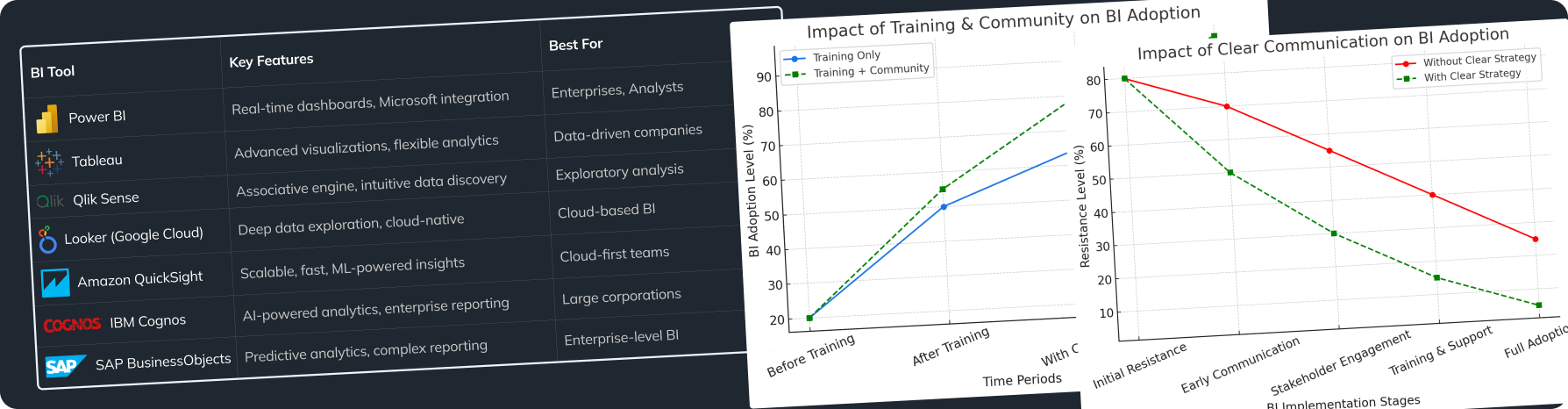

- Visualize in Looker Studio for real-time actioning.

- Measure impact with A/B-tests and iterate from hypothesis to ROI 🙂

Deploy proof of value (PoV), such as churn or LTV pilot with dashboards took on average 6 weeks.

Business impact what to expect

Short-term:

- Centralized and reliable data foundation (single source of truth).

- Clear KPIs and dashboards for faster, data-driven decisions.

- Immediate uplift from targeted retention campaigns and fraud prevention.

Mid-term:

- Statistically significant churn reduction and measurable LTV growth.

- Improved ROAS through smarter acquisition and creative optimization.

- Personalized player experiences driving higher engagement and session length.

Long-term:

- Scalable, production-ready analytics and ML infrastructure.

- Continuous optimization with automated retraining and monitoring.

- Data-driven product roadmap: better event planning, monetization strategies, and sustained revenue growth.